UK Film & TV Tax Incentive Changes – What You Need to Know for 2025

From 1 April 2025, important updates are coming to the UK’s film and TV tax incentives, with significant implications for productions using visual effects (VFX). Here's a quick overview of what's changing and why it matters.

What’s New?

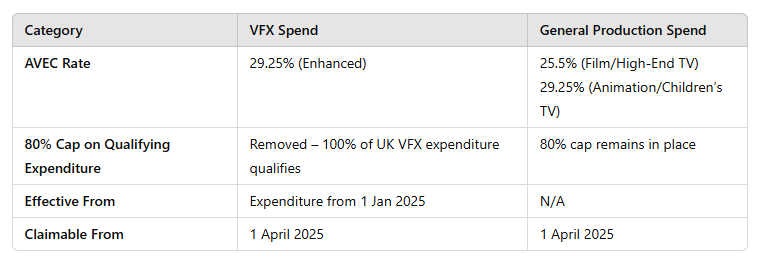

The UK government is introducing enhanced tax relief for VFX expenditure, effective from 1 January 2025, with claims eligible from 1 April 2025. This is part of the broader Audio-Visual Expenditure Credit (AVEC) scheme, which replaces the former tax relief models.

Key Differences: VFX vs General Production

Eligibility Criteria for All Productions

To access these incentives:

Productions must pass the UK Cultural Test.

At least 10% of total production spend must occur in the UK.

DOWNLOAD: A One Page Summary

Why It Matters

Boost to the UK VFX Industry

The increase in tax relief to a net rate of 29.25% for UK VFX expenditure, combined with the removal of the 80% cap, is expected to bring a significant influx of investment into the UK VFX sector. Industry estimates suggest an annual boost of around £175 million and the creation of approximately 2,800 new jobs across the sector.

Enhanced Global Competitiveness

Before these changes, productions often hit the cap on qualifying expenditure and looked overseas for more favourable financial conditions. The new structure makes the UK more competitive internationally, encouraging productions to base not only their shoots but also their VFX post-production work in the country.

Support for Innovation and Growth

The VFX sector contributes around £1.6 billion annually to the UK’s creative industries. Enhanced tax relief is expected to stimulate further innovation, improve pipeline capacity, and future-proof the industry’s global standing. It’s a strategic investment in both technology and the creative workforce.

Positive Industry Reception

Industry leaders have welcomed the update. Tracy McCreary, Managing Director of BlueBolt, called it "a very good day for the UK VFX and filmmaking community," highlighting that the uplift will help the UK compete globally, create jobs, and reinvigorate growth after a challenging period.

In Summary

The UK's updated tax relief framework signals a bold move to retain and grow its reputation as a world-leading hub for film, television, and visual effects. For general production, the AVEC scheme remains competitive, particularly for animation and children's TV, but it's the VFX sector that stands to gain the most.

By removing the 80% cap and introducing an enhanced 29.25% rebate, the UK is directly responding to global competition and production realities. These changes not only make the UK more cost-effective for studios but also create the conditions for sustained investment in talent, training, and technology. With predictions of thousands of new jobs and a boost of over £175 million in annual investment, the incentive is more than a fiscal measure – it’s a growth strategy.

Whether you're a domestic producer or an international studio planning your next VFX-heavy feature, the UK's evolving incentive landscape makes it a destination worth serious consideration.

Disclaimer:

The information provided in this blog post is for general informational purposes only and does not constitute financial, legal, or tax advice. While efforts have been made to ensure accuracy, we make no guarantees regarding the completeness or reliability of the content. Productions and studios should seek independent professional advice tailored to their specific circumstances before making any decisions.